carried interest tax rate 2021

The IRS released final regulations TD. The Biden administrations proposal to tax carried interest at a higher rate.

How Clever New Deals And An Unknown Tax Dodge Are Creating Buyout Billionaires By The Dozen Billionaire Sovereign Wealth Fund Carried Interest

2021 US HB6763 Summary To amend the Internal Revenue Code of 1986 to lower the corporate tax rate for small businesses and.

. Following its proposal to introduce a concessionary tax rate for carried interest earned from Hong Kong private equity funds on January 4 2021 the Hong Kong Government announced that eligible carried interest will be charged at a profits tax rate of 0 and that 100 of eligible carried interest will be excluded from employment income for the calculation of. This tax rate is lower than the income tax or self-employment tax which is the rate applied to the management fee. To amend the Internal Revenue Code of 1986 to lower the corporate tax rate for small businesses and close the carried interest loophole and for other purposes.

Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that. Ad Compare Your 2022 Tax Bracket vs. The final regulations generally retain the structure of proposed regulations issued last July but also make several important changes.

A key exemption from these rules is the carried interest exemption which if met means that amounts should be subject to capital gains tax at a lower rate of 28. Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead of higher ordinary income tax rates. 7 2021 providing guidance on the carried interest rules under Section 1061.

115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be eligible for capital gain treatment. The legislation is the culmination of an extensive consultation process. Your 2021 Tax Bracket to See Whats Been Adjusted.

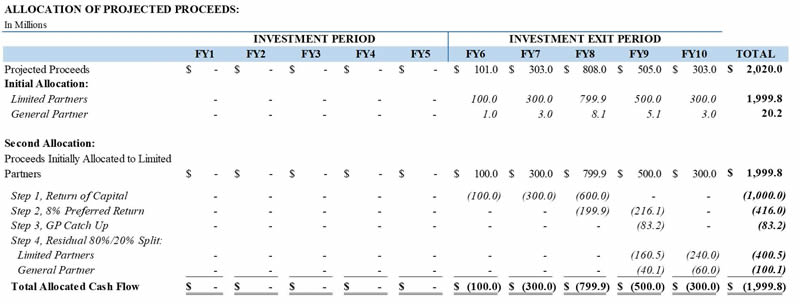

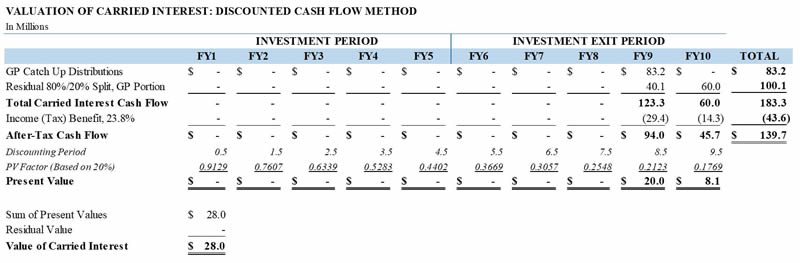

Carried interest offers lower tax rate than for income. A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. The managers pay a federal personal income tax on these gains at a rate of 238 percent 20.

Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax. This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of their taxable income if they earn over 40525 81051 for married couples filing jointly.

President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today. The carried interest loophole allows investment managers to pay the currently lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary. Proceeds from that individuals partnership interest are often taxed as capital gain rather than ordinary income.

Text for HR6763 - 117th Congress 2021-2022. Carried interest is the portion of an investment funds returns eligible for a capital gains tax rate of 15 or 20 instead of the ordinary income tax rate of up to 37. On January 7 2021 Treasury released tax regulations that clarify provisions enacted as part of the Tax Cuts and Jobs Act of 2017 which placed limits on the tax benefits associated with carried interests.

The preferential tax rate is especially important for a private equity fund and its managers. News June 30 2021 at 0208 PM Share Print. This means that private equity managers pay a lower marginal tax rate on the carried interest.

Listen to this article. The law known as the Tax Cuts and Jobs Act PL. September 13 2021 321 PM UTC.

Tax incentives include 0 tax rate for carried interest. The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its third reading in the Legislative Council unamended and once published in the official gazette will become law. Some view this tax treatment as unfair because the general partner.

Discover Helpful Information and Resources on Taxes From AARP. The IRS is required by law to pay interest on delayed tax refunds but the interest rate it currently pays on individual tax returns is only 3 percent10 That is well below the current inflation rate of around 7 percent meaning that taxpayers are paying a significant economic cost when the IRS fails to process their refunds in a timely manner. In general equity issued in exchange for services is taxable at ordinary income rates unless that equity is a profits interest.

Even within this exemption amounts can still be brought back within the DIMF rules if. Annual management fees are taxed as ordinary income currently subject to a top tax rate of 37. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie.

Section 1061 was enacted as part of the Tax Cuts and Jobs Act TCJA and requires a three. Carried interest is subject to capital gains tax.

Subordinated Debt Meaning Example Risk And More In 2021 The Borrowers Debt Financial Management

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Housing Affordability Continued To Improve In August 30 Year Mortgage Real Estate Marketing Mortgage Payment

Etsy Seller Fee Calculator Find Out Your Estimated Etsy Seller Direct Checkout And Paypal Fees Now Updated With N Etsy Seller Fees Etsy Advice Etsy Business

Foreign Investors Firpta Information For Selling Property In The U S Www Facebook Com Firstampho Real Estate Infographic Title Insurance Arizona Real Estate

Carried Interest What It Represents And How To Value It And Why Marcum Llp Accountants And Advisors

6 Ways To Pass Wealth To Your Heirs In 2021 Estate Planning Life Insurance Policy Money Mark

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Pin By The Taxtalk On Income Tax In 2021 Communications Seizures Tech Company Logos

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It 2021

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Carried Interest What It Represents And How To Value It And Why Marcum Llp Accountants And Advisors

Download Pre Gst And Post Gst Price Comparison Template In Excel Exceldatapro In 2021 Templates Pre And Post Excel

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)